Economy Does Better When a Democrat is in the White House

/151x0:980x529/prod01/channel_34/media/albers-school-of-business-and-economics/news-and-events/Ford-Carter-debate_Albers-School-of-Business--Economics-1130X529.jpg)

Economy Does Better When a Democrat is in the White House One hundred forty-four years of data -- from 1876 to 2016 -- show that when a Democrat is in the White House, the economy tends to grow faster and stock prices also tend to rise faster. When Republicans are Presidents, consumer prices are lower.

Economy Does Better When a Democrat is in the White House

One hundred forty-four years of data -- from 1876 to 2016 -- show that when a Democrat is in the White House, the economy tends to grow faster and stock prices also tend to rise faster. When Republicans are Presidents, consumer prices are lower.

This is just one of the many findings in a study by Werner De Bondt, Visiting Professor, Finance, and Thomas F. Gleed Endowed Chair of Business Administration for 2019-2020. De Bondt, a co-founder of the field of behavioral finance, studies the psychology of investors and financial markets.

De Bondt covers this comparison and more in Predictable Irrationality, the second in the Albers Deep Dive series of videos. Recorded exclusively for YouTube, the series comprises 30- to 45-minute slideshows presented by Albers faculty and subject matter experts.

De Bondt's research shows that macro-economic and capital market expectations play a key role in financial decision-making. The expertise of professional economic forecasters, he has found, is surprisingly limited. Thorough analysis of thousands of six- and 12-month forecasts of the Standard & Poor's 500 Index, from 1952 t0 2019, shows predictable bias.

According to De Bondt, 'Expert projections are poor because financial market developments are inherently capricious; because professional experts commonly promote themselves as “perma-bulls” or “perma-bears”; and because many economists are unjustifiably over-confident in their power to foresee the future.'

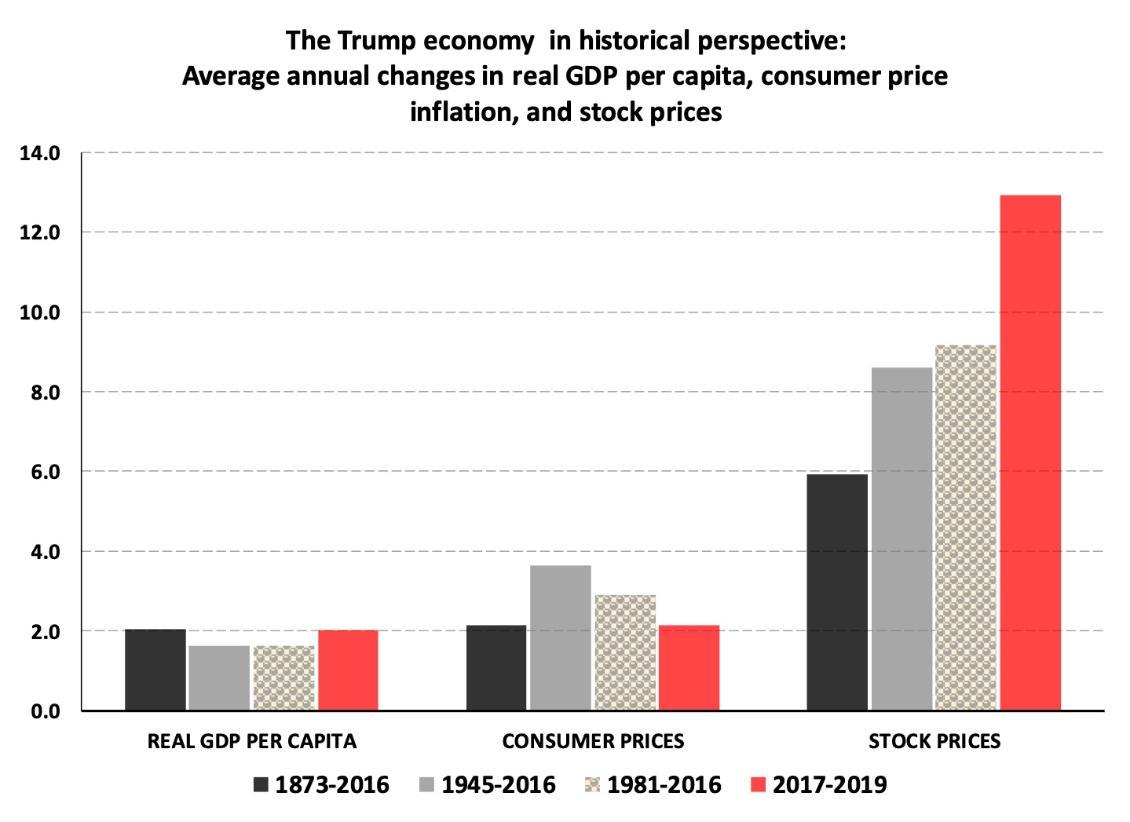

With 2020 being an election year, De Bondt analyzed economic performance under President Donald Trump:

- Comparing his performance to the averages since 1873, the Trump economy is just about equal to the long-term average, and significantly better than what has been achieved since 1945 or since 1981

- Inflation during his term is just about equal to the long-term average since 1873, and beats those since 1945 and 1981

- For stock market performance, the long-term average shows an annual gain of 5.9%. Under Trump, it grew 12.9%

Will the above get him re-elected in November? De Bondt says the COVID-19 pandemic is ‘the main imponderable factor’. His studies show that it’s not stock market performance over the full four years that matters, but the last 18 months.

Image: President Gerald Ford and Jimmy Carter meet at the Walnut Street Theater in Philadelphia to debate domestic policy in September 1976. Photo by David Hume Kennerly.

Friday, February 2, 2018

/250x0:2150x1200/prod01/channel_34/media/seattle-university/news-amp-stories/images/US-News-photo-banner.png)

/73x0:1128x666/prod01/channel_34/media/seattle-university/news-amp-stories/images/IMG_3962.jpeg)